EC proposes to make cross-border euro payments cheaper

- All intra-EU cross-border payments in euro outside the euro area will be priced the same, with small or zero fees, as domestic payments in the local official currency.

- Full transparency in currency conversion when consumers are paying by card in a country which does not have the same currency as their own. At the moment, consumers are usually not informed or aware of the cost of a transaction that involves a currency conversion. The proposal will therefore require that consumers are fully informed of the cost of a currency conversion before they make such payment.

The first point of the proposal would result in savings of EUR 1 billion to customers of banks, which also means a like amount of revenue lost for banks if it is adopted.

The gains for the consumers would be less revenue for the banks. However, it should be borne in mind that the costs of euro transactions are low, also for banks in non-euro Member States and that these lower costs have not been passed on to consumers,

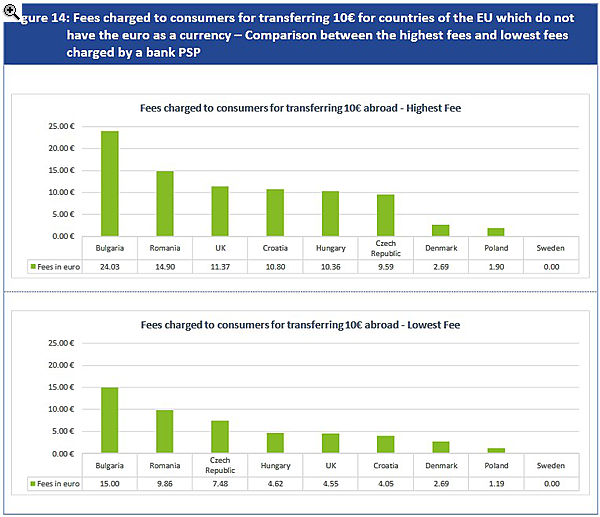

Dombrovskis pointed out.While within the euro area, businesses and households can transfer euros abroad for a nominal fee, fees for a simple credit transfer can be exorbitant in some non-euro area member states (up to EUR 15 for a transfer of EUR 10).

According to a report commissioned by the EC, Hungary is in the middle of the pack as far as the cost of transferring between EUR 10 and EUR 1,000 cross-border is concerned, with fees ranging from EUR 4.62 to EUR 12.38.

As regards savings from currency conversion, they have not been estimated, as it would be difficult to model the responses of market participants (consumers and providers) to increased transparency,

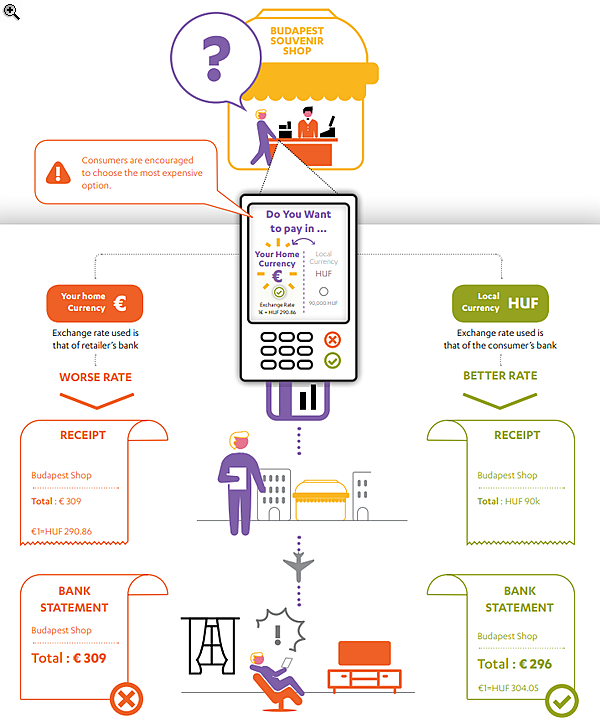

Dombrovskis said.At present, when using a card to make a purchase or to withdraw cash from an ATM, most merchants or ATM operators offer Dynamic Currency Conversion (DCC), which means the party making the payment is not paying in their home currency (say, forints in the case of Hungarians), but the amount is converted to euros at a non-transparent exchange rate. In contrast, paying in forints and having the bank exchange the amount to euros at the advertised rate typically comes out cheaper than DCC.

A European Consumer Organization (BEUC) study showed that in 998 cases out of 1,000, consumers paid more using dynamic currency conversion.

Merchants offering Dynamic Currency Conversion (DCC) now (or ATM operators) would display on their terminals a choice between paying in the local and in the home currency of the consumer, the latter implying a currency conversion done by the merchant’s/operator’s DCC provider. Today, it's nearly impossible to know how much we will end up paying for purchases. This is because at the moment we pay, we are not given any indication on currency conversion rates. The European Commission will request the European Banking Authority (EBA) to develop technical standards (RTS) to spell out how the costs of the different options can be made absolutely clear,

Dombrovskis told Portfolio.The expected timeline Valdis Dombrovskis gave Portfolio is as follows:

- 1/1/2019: Reduced cross-border transaction charges apply;

- 1/1/2020: RTS published in the OJ; caps on currency conversion charges apply;

- 1/1/2022: Transparency rules apply; caps discontinued.

This is based on the assumptions that the Regulation is adopted by the European Parliament and the Council in early December at the latest; and that the EBA RTS can be finalised within one year (so no substantive amendments from the Commission requiring a second consultation of EBA, no extension of the scrutiny period by the European Parliament or Council and no rejection).