Economy

Hungary forint eases to over 326 vs. euro

USD firming bad for CEE currencies - 11:11

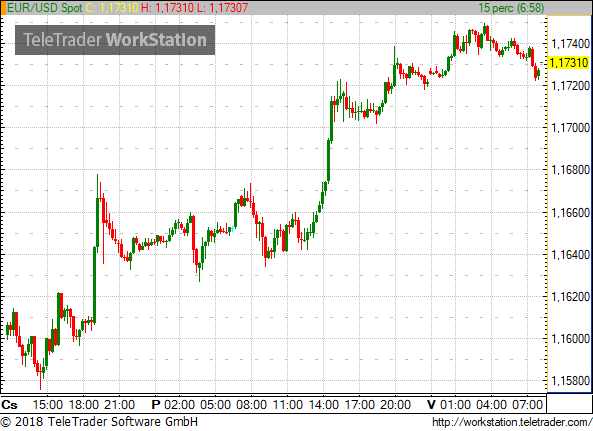

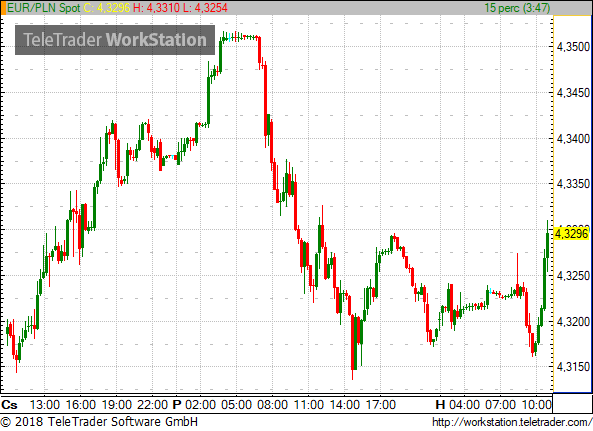

The sell-off of Central and Eastern European currencies started in tandem with the strengthening of the USD which was losing the game against the euro in the morning but has firmed 0.2% already compared to its closing level on Friday. This marks an intraday appreciation of nearly 0.5%, and the cross is approaching 1.17.

HUF turns around 11:08

The forint has started to ease versus the euro and it is currently quoted north of 326.50, which marks an 0.3% HUF easing compared to Friday’s closing level.

HUF corrects on Friday, but starts week north of 325 vs. EUR - 08:23

The forint starts the week at 325.35 to the euro, marginally firmer than Friday’s closing level. The HUF managed to recover at the end of last week as on Friday morning it was still at 327 against the single European currency and it seemed it was eyeing the all-time low at 330 again. Yet, it’s too early to sigh in relief for international sentiment could turn dour at any moment and send EUR/HUF flying close to 330. The HUF is currently quoted at 277.40 to the USD and at 364.46 versus the British pound.

The euro has firmed some more to the USD, continuing the trend we have seen in the second half of last week. The cross has apparently turned around at 1.15 and it is currently at 1.1731, which marks a 0.1% euro strengthening. Meanwhile, Japan’s yen gained 0.5% to the UDS, while the GBP firmed 0.1%.