Hungary forint could find itself in vicious circle, analysts warn

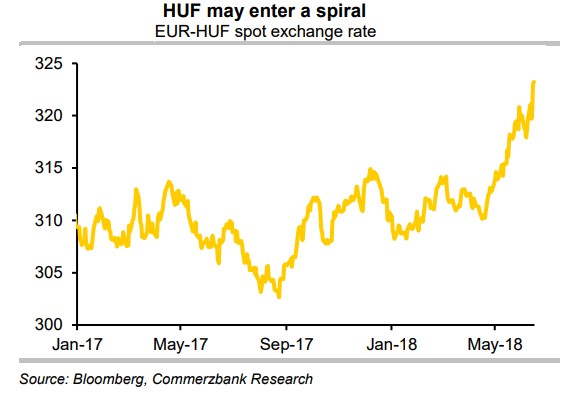

What makes the Hungarian move significant is that the currency has weakened to a new low versus the ultra-weak euro (see chart below) and the move shows signs of accelerating.

They noted that the forint has not weakened dangerously yet and could still stabilise on its own if euro zone risks were to calm down. But, the move may continue, which is why this is the right time to recapitulate HUF-specific macroeconomic risks.

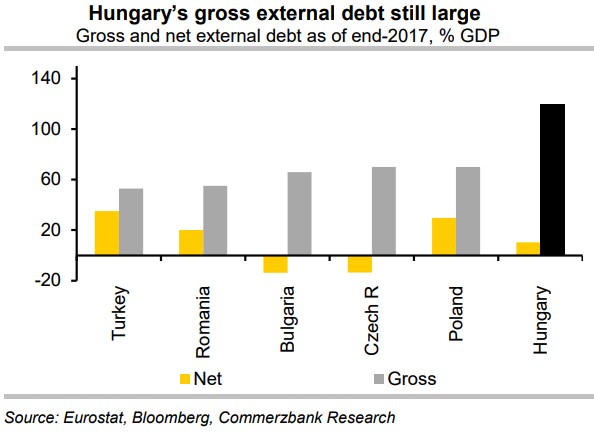

Turkey’s currency crisis was fuelled by a wide current-account deficit and high inflation - these factors are not a major danger for Hungary - the country enjoys a nice 3% of GDP current-account surplus. But, Hungary’s vulnerability is the still large external debt: at the end of last year, this stood at c.120% of GDP (for a peer group comparison, see chart). More recent data show that debt/GDP could have declined closer to 100%. Still, this is a high number.

The analysts underlined, however, that loose monetary policy is indeed a common factor with Turkey.

“The reason the forint has been exposed to depreciation pressure this year is the central bank’s ultra-loose monetary policy stance.

The MNB has signalled that rates are likely to remain on hold through 2019, while further monetary easing could be undertaken using unconventional policy tools - the central bank already conducts prominent swap market operations to achieve the latter. As a result, interbank interest rates (3m BUBOR) are just 0.15% at the moment. Inflation is 2.8% headline, and 2.2% core (MNB target: 3%) - inflation is expected to accelerate modestly in coming months. Hence, the real interest rate is somewhere in the -2.4% range. Compare this to a central bank such as Poland’s NBP, which has 1.5% policy rate and 0.5% core inflation - therefore, a positive real interest rate.

The analysts also pointed out that FX liabilities increase when the forint weakens.

“The channel via which forint depreciation could feed back to become a spiral is external liabilities. External debt service obligations for 2018-19 will total around EUR 7-10bn each year, which is larger than the EUR 3.6bn current-account surplus. Forint depreciation increases the net external financing requirement in local currency terms. This, in turn, warrants a weaker exchange rate and higher real interest rate. Meanwhile, the weaker exchange rate is already boosting inflation and bringing the real interest rate down, which feeds back to weaken the exchange rate again, therefore calling for an even higher interest rate to break the spiral."

As regards the implications for monetary policy, the analysts noted that the benign EM risk environment of recent years allowed EUR-HUF to trade sideways for the most part.

“MNB’s ultra-loose monetary policy did not have a noticeably adverse effect. This year, with UST yields rising, EM assets are under strain and the HUF has begun to depreciate. The ultra-loose policy stance of MNB has the potential to escalate this into an FX spiral," they warned.

In their view, things have not yet escalated that far.But as headline inflation reaches and exceeds the 3% target, which it will likely do over the coming quarters, the market may lose confidence that the central bank has full control - in this situation, the market would test MNB’s willingness to raise rates, just as it did with CBT.

The analysts believe that the Hungarian central bank will probably act in pre-emptive manner to hike rates. But, because of its well-known dovish bias, the market may demand ‘proof’. This is why we heard Deputy Governor Márton Nagy warn last week that MNB will be ready to hike rates.“The message needs to be louder and clearer," they concluded.